Innovating

banking and finance

one nation at a time.

Haifin, a trailblazing trade finance platform, leverages Blockchain (DLT) and Applied Analytics Intelligence to ensure transactional security and authenticity. Our platform currently hosts 14 commercial and Islamic banks along with 5 Fintech’s in the UAE.

Empowering global trade finance

Welcome to Haifin, where the future of trade finance begins. As a pioneering platform powered by blockchain (DLT) and Applied Analytics Intelligence, we’re redefining banking with unrivaled security, transparency, and efficiency. Our state-of-the-art fraud detection protects billions in transactions for our consortium members. At Haifin, we’re committed to a financial ecosystem that seamlessly blends innovation with reliability, setting bold new standards for the global landscape.

Synergistic co-creation: Collaborating for innovation

At Haifin, our transformative vision thrives on the power of co-creation, bringing together internal enterprise experts, external developers, and domain specialists to achieve a historic milestone: the nation’s first commercially available blockchain distributed ledger application (DApp) and applied analytics. This collaborative approach, redefines trade finance in banking with unmatched security, transparency, and efficiency. By fostering innovation through shared expertise, Haifin is committed to shaping a future where trust and collaboration drive global financial excellence.

Mitigating risks

in invoice

financing

Our platform is built to reduce risks in Trade Finance. With rigorous validation procedures and advanced anomaly detection systems, we we ensure dependable and reliable transactions for all parties involved

Mitigating risks in invoice

financing

Our platform is built to reduce risks in Trade Finance. With rigorous validation procedures and advanced anomaly detection systems, we we ensure dependable and reliable transactions for all parties involved

Unifying lending

institutions on a

single platform

Unifying lending

institutions on a single

platform

Complete

paperless

process

Complete paperless

process

Addressing industry

challenges with

new use cases

- Electronic Bank Guarantees: eBG

- National e-Invoice Registry

- Anti-Money Laundering Initiatives

- Digitizing Identity Verification: eKYC and eKYB

Addressing industry

challenges with

new use cases

Electronic Bank Guarantees: eBG

National e-Invoice Registry

Anti-Money Laundering Initiatives

Digitizing Identity Verification: eKYC and eKYB

haifin's cutting-edge technological pillars:

Blockchain

At Haifin, we harness the power of blockchain (DLT) to deliver unmatched traceability and immutability. Every transaction is permanently etched into a secure record, ensuring total transparency.

Cloud Native

Seamless Connectivity

Our platform thrives on effortless integration, powered by advanced APIs. This allows smooth, hassle-free connections between the platform, backend systems, and other applications, keeping everything in perfect sync.

Applied Analytics Intelligence

Our tools analyze trends for smarter decision-making, effortlessly manage complex tasks, and quickly detect suspicious patterns or anomalies.

Banking Grade

Cybersecurity

Security is our priority. We adhere to the highest banking and regulatory standards, safeguarding your sensitive data with state-of-the-art encryption. Our compliance with key protocols, including GDPR, ensures your trust and peace of mind.

Banking grade

technology

Consortium Members

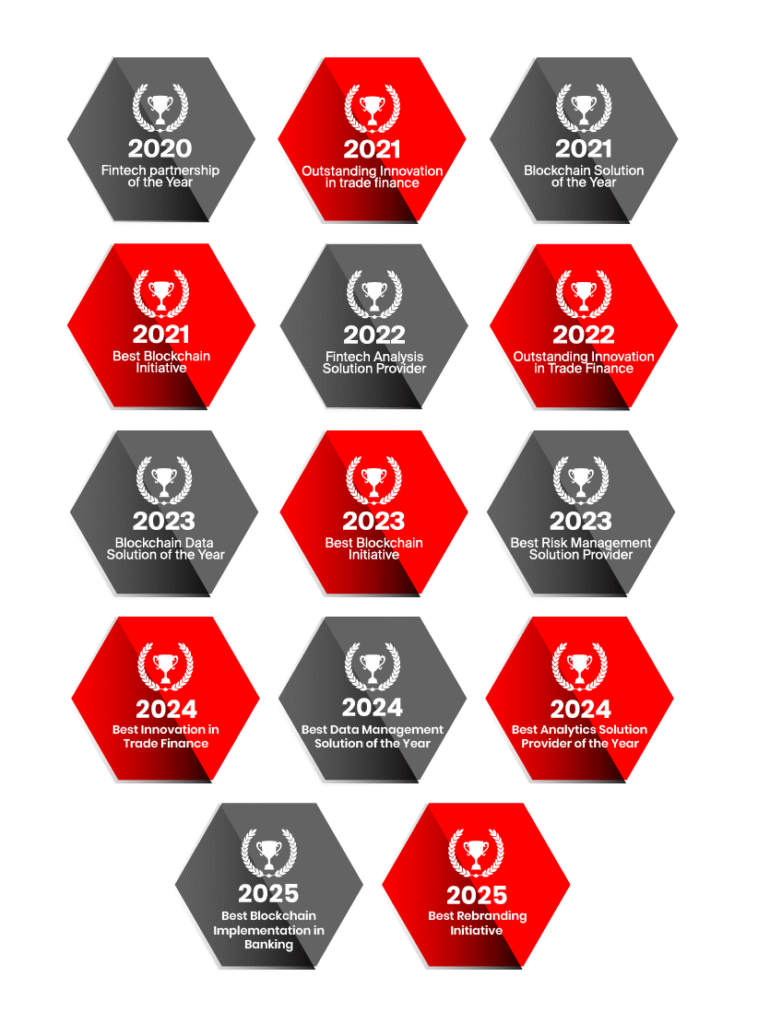

Awards

Our Certification

Memberships

Testimonials

Ali Sultan Rakkad Ali Amri

Chief Executive Officer

Sara Al Binali

Group Head of Corporate, Commercial,

and International Banking

FAB is proud to lead haifin an industry wide solution aimed at digitising trade in the UAE, along with  and UAE banks. By developing innovative solutions like haifin FAB is addressing critical industry challenges related to duplicate and fraudulent invoices, which have had an adverse effect on SME financing. Haifin will provide enhanced knowledge of the trade financing transactions to banks thereby improving liquidity and funding to corporates and SMEs in UAE.

and UAE banks. By developing innovative solutions like haifin FAB is addressing critical industry challenges related to duplicate and fraudulent invoices, which have had an adverse effect on SME financing. Haifin will provide enhanced knowledge of the trade financing transactions to banks thereby improving liquidity and funding to corporates and SMEs in UAE.

Vince Cook

Chief Executive Officer (Retired)

I think bringing together all of the banks to collaborate on an industry challenge has been a very powerful itiative by haifin. Specifically, for us it means that we can trust the transactions that we are being asked to look at by our customers and know that this is a single piece of financing and not something that is dubious, so it is very powerful for us.

Dr. Bernd Van Linder

Chief Executive Officer

The haifin platform will not only help reduce fraud, it will also reduce the opportunity for fraud. Typically, when you look at fraud, it’s a small group of bad actors that spoil the market for everybody else. The guarantee of the authenticity of invoices provided by haifin will help to ensure that banks in the UAE will take greater comfort in financing against these invoices.

Raheel Ahmed

Chief Executive Officer

The tremendous growth of the UAE has been greatly aided by finance and it will continue to be a vital aspect in the future, especially given the country’s status as a key regional trade hub. RAKBANK is proud to be one of the leading banks on the haifin platform, which was created to bring banks together to collaborate on the industry challenge of addressing the issue of fraudulent invoices. The platform upholds the transparency and accountability of financial institutions within the trade ecosystem. This cutting-edge platform is transforming the financial industry with its innovative approach and universal platform, securing the stability and credibility of the trade finance for the long term.